Renters Insurance in and around Norwalk

Get renters insurance in Norwalk

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Norwalk, IA

- Des Moines, IA

- Indianola, IA

- Cumming, IA

- Carlisle, IA

- Martensdale, IA

- Prole, IA

- West Des Moines, IA

- Van Meter, IA

- Winterset, IA

- St Charles, IA

- Osceola, IA

- Waukee, IA

- Urbandale, IA

- Johnston, IA

- Grimes, IA

- Windsor Heights, IA

- Clive, IA

- Pleasant Hill, IA

- Altoona, IA

- Ankeny, IA

- New Virginia, IA

- Chariton, IA

- Corydon, IA

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - utilities, outdoor living space, price, condo or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Norwalk

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

The unpredictable happens. Unfortunately, the possessions in your rented property, such as a tool set, a bed and a set of favorite books, aren't immune to burglary or accident. Your good neighbor, agent Sam Sorenson, is passionate about helping you figure out a policy that's right for you and find the right insurance options to protect your belongings.

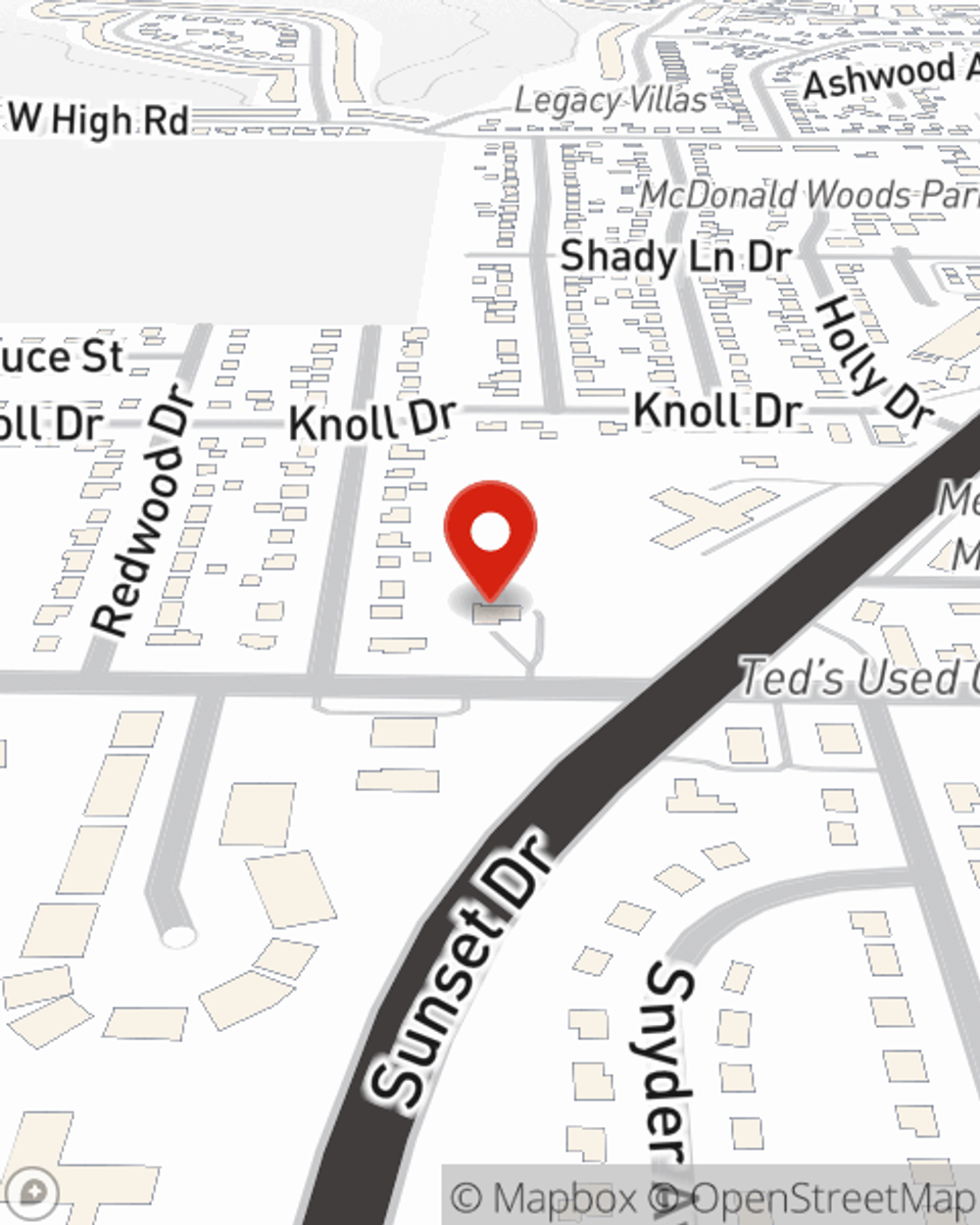

Get in touch with State Farm Agent Sam Sorenson today to explore how the leading provider of renters insurance can protect items in your home here in Norwalk, IA.

Have More Questions About Renters Insurance?

Call Sam at (515) 981-5432 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Sam Sorenson

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.